Featured Article

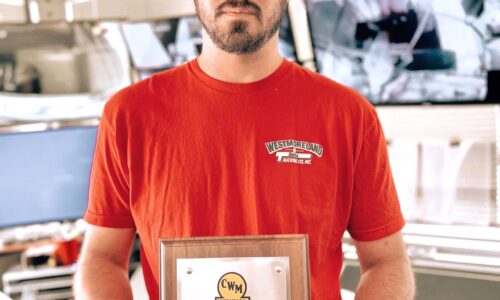

Employee Highlights: Going the Extra Mile

Featured Position

Grade Checker

For anyone with a 401(k), it is painful to see negative market headlines reflected in your account balance. For investors too young to remember the crashes of 2000 and 2008, this could be the first exposure to significant losses in your retirement savings. For those who do remember the last market crashes, this year is likely bringing back memories of tough times. As financial advisors, we never want to minimize that losses are painful. However, it is our job to provide context for why the market is changing, and to provide encouragement for why you should not panic or lose hope. Here are three key points to understand about the current state of the markets today.

The effect of inflation on the American consumer is evident every time we drive by a gas station, or go to buy groceries, and efforts by the Federal Reserve to slow inflation have largely failed thus far. When the consumer price index (CPI) rose 8.6% in May 2022 compared to May 2021, America saw the highest level of inflation recorded since 1981. This continued rise prompted the Federal Reserve to raise interest rates by .75% instead of the expected .50% on June 15th. By raising rates, business loans and mortgages become more expensive, reducing the oversupply of money that contributes to inflation. This move also punishes the stock and bond markets, with riskier assets such as cryptocurrency and technology growth stocks falling the fastest. However, it is critical to understand that high inflation cannot be tamed without a cool down in the economy and the stock market. The Fed has made it clear that they intend to move more aggressively to curb the threat of runaway inflation.

The biggest mistake 401(k) investors make is checking their account too often. Keep in mind that these funds are specifically meant for retirement, and for the vast majority of investors, there is still time on the horizon. Regardless of whether you have 5 years or 30 years until retirement, think of down markets as an opportunity to invest at a discount. Continue to remain disciplined with contributions and avoid taking out loans or early withdrawals to keep your money invested. If you are invested in a target date fund, keep in mind that your investments are automatically rebalanced for you based on your age and risk bracket. For the majority of 401(k) investors, the best thing you can do is stay disciplined over the long term.

The possibility of a recession in the American economy has been looming over 2022, and it is impossible to predict whether it will happen or not. While we won’t speculate on the chances of a recession, we will advise that the cost of energy and household goods will likely remain high in the near term. Interest rates on credit cards, adjustable-rate mortgages, and new loans will climb as the Fed continues to raise rates. With markets falling and real estate prices beginning to drop, we find ourselves between a rock and a hard place. In times like these, it is our recommendation to prepare yourself through wise financial decision making. This is a great time to sharpen up the household budget, set aside an emergency fund of cash, and limit your credit card debt. Hold off on unnecessary large purchases and speak with your family about spending habits. Financial discipline can feel paralyzing at first, but it all comes down to small steps and conversations.

If you ever want to talk about your account or your investments, call or text me (Luke Burton) at (770-268-1805). You can also email me at 401k@cwmatthews.com. You can also listen to Narwhal Capital’s daily stock market podcast, “The Investing Podcast” on Apple Podcasts or Spotify, where we cover daily news for all investors.